Vote for Bill C-234

Canadian farmers, growers

and ranchers drive our economy

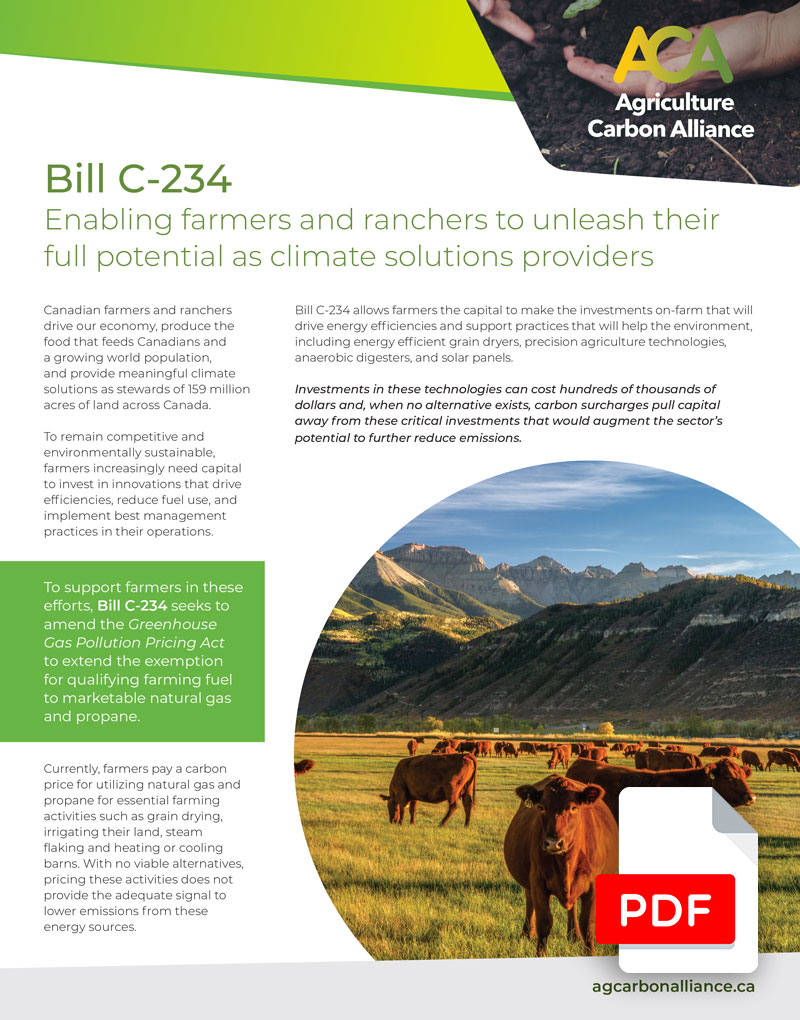

On-farm innovations and efficiencies such as energy-efficient grain dryers, precision agriculture technology, anaerobic digesters and solar panels can cost hundreds of thousands, if not millions, of dollars. With no viable fuel alternatives, carbon surcharges pull capital from critical investments that would otherwise augment the sector’s potential to reduce emissions further and support food security.

Contributing

to the agri-food sector’s

$135 billion to our gross domestic product and provide

1 in 9 Canadian jobs.

Producing

the food that feeds Canada and the world.

Providing

meaningful climate solutions as stewards of 154 million acres of land across Canada by increasing production while maintaining relatively stable emission levels: a 50% decrease in GHG emission intensity from 1997-2017 alone.

An Exemption

is the Best Solution.

To support farmers in their efforts, Bill C-234 seeks to amend the Greenhouse Gas Pollution Pricing Act to extend the exemption for qualifying farming fuel to marketable natural gas and propane. The current carbon price rebate, introduced last year through Bill C-8, does not fully account for the individual breadth of carbon surcharges applied to farms.

Farmers pay a carbon price on essential farming activities such as irrigation, grain drying, feed preparation, heating or cooling of barns and other agricultural growing structures.

Bill C-234 would provide an exemption, limited to on-farm fuel use for these necessary farm practices, allowing farmers to invest their money in the efficiency of their operations.

A vote for Bill C-234 is a vote for:

FAQ

Why is Bill C-234 needed?

Due to the disconnect between carbon surcharges paid and the existing rebate, coupled with the lack of viable alternatives for many critical on-farm climate change mitigation practices (e.g. drying grain, irrigation, feed preparation, heating and cooling barns, greenhouses and other agricultural growing structures), a targeted and time-limited carbon pricing exemption for specified on-farm fuel uses is the right approach moving forward to ensure producers have the capital needed to invest in on-farm efficiencies and sustainability improvements.

Aren’t farmers already receiving rebates for carbon pricing? Would C-234 lead to double dipping?

Yes, farmers are receiving rebates. While Bill C-234 does present the potential for an overlap with the existing rebate offered in backstop provinces, the government has the capacity to resolve this concern after receiving royal assent through a simple policy directive to CRA to not process rebates where an exemption exists.

Why an exemption over a rebate?

Unfortunately, the current rebates are based purely on eligible farming expenses and do not cover all carbon surcharges that farmers pay. In reality, farmers pay much more in taxes than they get back in refunds. We believe that the right approach is to proceed with a targeted and time-limited carbon pricing exemption for specified on-farm fuel. This in turn will allow farmers to keep more working capital to invest back in the efficiency and sustainability of their operations. Investments in these technologies can cost hundreds of thousands of dollars and, when no alternative exists, carbon surcharges pull capital away from these critical investments that would augment the sector’s potential to further reduce emissions.

Are these exemptions permanent?

Bill C-234 includes a sunset clause that would expire after eight years from the date of royal assent, allowing the government of the day to determine if there are viable alternatives in place other than natural gas and propane for food production.

Are on-farm exemptions new?

No, when the Greenhouse Gas Pollution Pricing Act was first introduced, it recognized that farmers, growers and ranchers had no viable alternatives on farm other than gasoline and diesel. As such an exemption was put in place to remove carbon pricing for these fuels.

Bill C-234 seeks to tidy up those exemptions by also including natural gas and propane, for which there are also no viable alternatives.

Did Bill C-234 receive multi-party support in the House of Commons?

Yes, Bill C-234 received multi-party support in the House of Commons, with unanimous support from the Green Party, NDP, Bloc and Conservatives. Some Liberal MPs voted in favour of the bill as well, including the Chair of the House of Commons Standing Committee on Agriculture and Agri-Food.

Are any further amendments needed?

ACA members are urging Senators to swiftly pass Bill C-234 into law without amendments. The bill is fit for purpose, and further amendments in the Senate would delay the passage of this important legislation, allowing for the potential to die on the Order Paper, as similar bills have done in the last Parliament. The exemption Bill C-234 provides is long past due for farmers, ranchers and growers.

Hasn’t this bill been in Parliament before?

Two bills in the last Parliament sought to seek natural gas and propane exemptions under the Greenhouse Gas Pollution Pricing Act for farming activities: Private Members’ Bill C-206 (sponsored by MP Phillip Lawrence), and S-215 (ret. Senator Dianne Griffin). Both bills did not reach royal assent before the 2021 federal election. C-234 is a marriage of the best of both C-206 and S-215, with additional enhancements, to ensure eligible farming machinery is inclusive of all farming practices that require natural gas or propane, such as drying grain, irrigation, feed preparation, heating and cooling barns, greenhouses and other agricultural growing structures.

Why should we be exempting farmers from carbon pricing if agriculture is among the sectors with the highest levels of emissions?

Farmers have always been stewards of the environment, their livelihoods depend on it. Unfortunately, currently there are no viable options other than using natural gas and propane for necessary farming practices, such as irrigation, grain drying, feed preparation, heating or cooling of barns and other agricultural growing structures. To make enhancements that support both food production and reduction in emissions, farmers need to continue to invest in their operations. With increasing input costs, coupled with a rising price on carbon, less money is available to make these investments. With the passage of Bill C-234, farmers will have access to more working capital to invest in the sustainability and productivity of their operations.

Will this erode the carbon price signal?

No, we understand the ethos behind carbon pricing as a tool to reduce emissions by encouraging behavior changes. However, in primary agricultural production the price on carbon simply adds to costs, with farm fuel already one of the most significant. There is already a strong incentive in place to reduce fuel use wherever possible, which is reflected in Canadian agriculture’s unparalleled productivity improvements over the past half century. Farmers have no choice but to dry their grain when harvested wet to ensure there isn’t food spoilage and to properly heat or cool their livestock barns to ensure animal welfare.

Why are further exemptions for farmers needed?

Only on-farm use of gasoline and diesel is currently exempted, yet farmers continue to pay thousands, if not tens of thousands of dollars in carbon pricing every year on necessary farming practices that utilize natural gas or propane. Bill C-234 addresses this shortcoming, ensuring there is a holistic approach to on-farm exemptions being applied to carbon pricing.

Which provinces will this bill apply to?

Bill C-234 will exempt farmers in the backstop provinces and territories where the federal fuel charge currently (Spring 2023) applies: Ontario, Manitoba, Yukon, Alberta, Saskatchewan, Nunavut, Nova Scotia, Prince Edward Island, Newfoundland and Labrador, and New Brunswick. Our hope is that this exemption, as a best practice to support agricultural efficiencies and sustainability, will then be reflected in provincial plans to align with the federal framework.

Since farmers are price takers, and therefore cannot pass down costs, wouldn’t it be a better approach to provide income support to farmers, rather than give them an exemption from carbon pricing?

Canadian farmers take pride in what they do – growing food for Canadians, supporting local communities and contributing to our economy. They are entrepreneurs and many farms have been successfully producing food for decades. Farmers, ranchers and growers have a proven record of implementing best management practices, growing more food using the same amount of land and decreasing their environmental footprint on their own. At this moment, there are no viable options for farmers other than to use natural gas and propane in their operations. Bill C-234 is the simplest and most effective approach to help leave money in farmers’ pockets so that they can continue to thrive and contribute to Canada’s economy.

Should the government be able to reduce the 8 year exemption if some viable options emerge withing the next couple of years?

No, a wholesale change in technology and the necessary infrastructure to support new alternatives will take time. Farmers have been reducing their carbon footprint for decades, without any carbon pricing incentives. They care about the environment and will continue to implement best management practices and invest in innovations on their farms, whenever possible. The bill needs to be passed and provide much needed relief to farmers as soon as possible. If alternative energy sources become viable, the government can decide if an amendment is required at that time.

Supportive Quotes From Our Members

Canadian Federation of Agriculture

“As farmers often have no viable fuel alternatives for critical food production activities, the carbon tax creates a large financial burden without any potential for significant emission reductions. In order for farmers to make investments into technologies that enhance their efficiency and sustainability, they need access to the working capital. Bill C-234 would keep those funds in farmers’ hands and allow them to make the necessary investments that will allow our sector to unleash its potential as a natural climate solutions provider.”

– Keith Currie, President of the Canadian Federation of Agriculture

Canadian Pork Council

“Pork producers are at the forefront of sustainable efforts, raising the bar for environmental stewardship. However, due to a lack of alternatives, our journey towards a greener future faces a roadblock in the form of fossil fuel dependency. The transformation to energy efficiency requires more than just a technological adjustment; it demands a technological shift in the form of an investment of resources, knowledge, and partnerships. Bill C-234 will give us the time to take proper steps and, together with sector partners, the government, and the research community, harness sustainable energy solutions while remaining competitive on the world market.”

– René Roy, Chair of the Canadian Pork Council

Grain Growers of Canada

“Canada’s grain farmers welcome the introduction of this bill and appreciate the exemptions included for critical on-farm activities – including grain drying. Through this relief from the carbon tax, our farmer members would have additional capital to invest in innovative technologies and sustainable practices that reduce emissions.”

– Andre Harpe, Chair of Grain Growers of Canada

Canadian Hatching Egg Producers:

“Canada’s hatching egg farmers represent an important segment of the poultry industry. Our farmers work hard to be at the forefront of innovation for sustainability while striving for efficiency at every opportunity. Bill C-234 will provide necessary support on farms to help alleviate financial pressures and ensure capital is available to reinvest in our farm operations to continuously improve our sustainability.”

– Brian Bilkes, Chair of Canadian Hatching Egg Producers

Canadian Canola Growers Association

“Canola farmers are proud stewards of the land and are always looking to make improvements. However, to maintain the quality of our crop, grain drying has become an integral part of our operations and can cost thousands of dollars each year. Currently, there are no viable options other than natural gas or propane to dry canola. The exemption provided by Bill C-234 will be a huge relief for canola farmers like me, and will provide an opportunity to re-invest in the efficiency of our farms and support food security.”

– Roger Chevraux, Chair of Canadian Canola Growers Association

Canadian Cattle Association

“Beef farmers and ranchers continue to be leaders in sustainability and are continually making environmental improvements in managing their operations, which contribute towards the Canadian beef industry’s 2030 goals. Bill C-234 will aid these environmental goals by providing necessary exemptions for essential farm practices, including steam flaking and temperature regulation for livestock barns.”

– Nathan Phinney, President of Canadian Cattle Association

Fruit & Vegetable Growers of Canada

“Canadian fruit and vegetable growers are committed to being a part of global climate solutions and the sustainability of their operations. We believe the support for farmers found in Bill C-234, will incentivize continued innovation, and recognizes that farmers need a range of feasible fuel and energy options. Ultimately, this will benefit the entire food value chain, including Canadian consumers.”

– Jan VanderHout, President of Fruit & Vegetable Growers of Canada

Chicken Farmers of Canada

“Canadian chicken farmers constantly advance our operations in order to improve bird health and welfare, and to ameliorate environmental stewardship and sustainability on the farm. Through the implementation of good production practices, chicken farmers are taking steps to ensure that our sector is environmentally sustainable for decades to come. We look to our partners in government and in the House of Commons to provide legislative and financial support for farmers so we can keep feeding Canadians.”

– Tim Klompmaker, Chair of Chicken Farmers of Canada

National Cattle Feeders’ Association

“Canada’s feedlot sector embraces innovative practices that support competitiveness and sustainability. To compete in an integrated North American market, cattle feeders carefully manage input costs including feed and fuel.

Cattle feedlots rely on the use of propone and natural gas for essential practices including on-farm grain drying, on-farm steam flaking (feed preparation) and irrigation of feed crops. The financial relief provided by Bill C-234 supports a viable Canadian beef sector and represents an opportunity for industry to further invest in environmentally-sound practices.”

– Will Lowe, Chair of National Cattle Feeders’ Association

Mushrooms Canada

“Canadian farmers are at a competitive disadvantage without Bill C-234. Specific to mushroom production, the carbon tax penalizes our industry for producing food year round. Growing a crop during the winter is no easy feat, but is needed to supply Canadians with fresh local food year round. Should this crucial bill pass, mushroom farmers would see a much needed reprieve from the carbon tax on growing room heating costs. Mushrooms are a sustainable choice and mushroom growers are committed to reducing their carbon footprint.”

– Mike Medeiros, President of Mushrooms Canada

National Sheep Network

“The National Sheep Network (NSN) represents 75 percent of Canada’s ewe flock that have joined together to leverage resources and producer leadership on issues of mutual interest. The NSN is producer driven and initiative focused to find innovative solutions to challenges facing the sheep

industry. Sheep farmers are committed to environmental practices to meet Canada’s sustainability goals. Our members appreciate the legislative changes in Bill C-234 that will support our sustainability

efforts.”

– Pierre Lessard, Chair of National Sheep Network

Canadian Seed Growers’ Association:

“Seed is essential to a sustainable and thriving agriculture and agri-food sector, and supporting the sustainable production of seed is led by our dedicated seed growers. Bill C-234 is a crucial step towards supporting our seed growers and farmers by recognizing their unique challenges in reducing greenhouse gas emissions while maintaining essential farming activities. Farmers, growers, and ranchers have no other viable alternatives, and by extending the exemption, this Bill will both reduce the cost burden on farmers and empower them to invest in the efficiency of their operations and a sustainable future for Canadian agriculture. The Canadian Seed Growers’ Association proudly stands in support of Bill C-234 and the tireless work our seed growers, farmers, and ranchers do for Canadian agriculture.”

– Dale Connell, President of Canadian Seed Growers’ Association

Turkey Farmers of Canada:

“Turkey farmers across Canada are committed to continuous enhancement of their farms’ sustainability and environmental efficiency, while focusing on the health and welfare of their birds. We know that many turkey farmers have indicated they upgrade their operations with sustainability in mind. Bill C-234 will alleviate financial costs and support turkey farmers in providing sustainably produced, safe, and nutritious food to Canadians.”

– Darren Ference, Chair of Turkey Farmers of Canada