The Impact Of Carbon Pricing On Farmers, Growers and Ranchers

On-farm innovations and efficiencies such as energy-efficient grain dryers, precision agriculture technology, anaerobic digesters and solar panels can cost hundreds of thousands, if not millions, of dollars.

With no viable fuel alternatives, carbon surcharges pull capital from critical investments that would otherwise augment the sector’s potential to reduce emissions further and support food security. We recently asked farmers from across Canada to #ShowYourReceipts and demonstrate the real cost of the carbon tax on Canadian farmers, growers and ranchers.

Here’s What We Found.

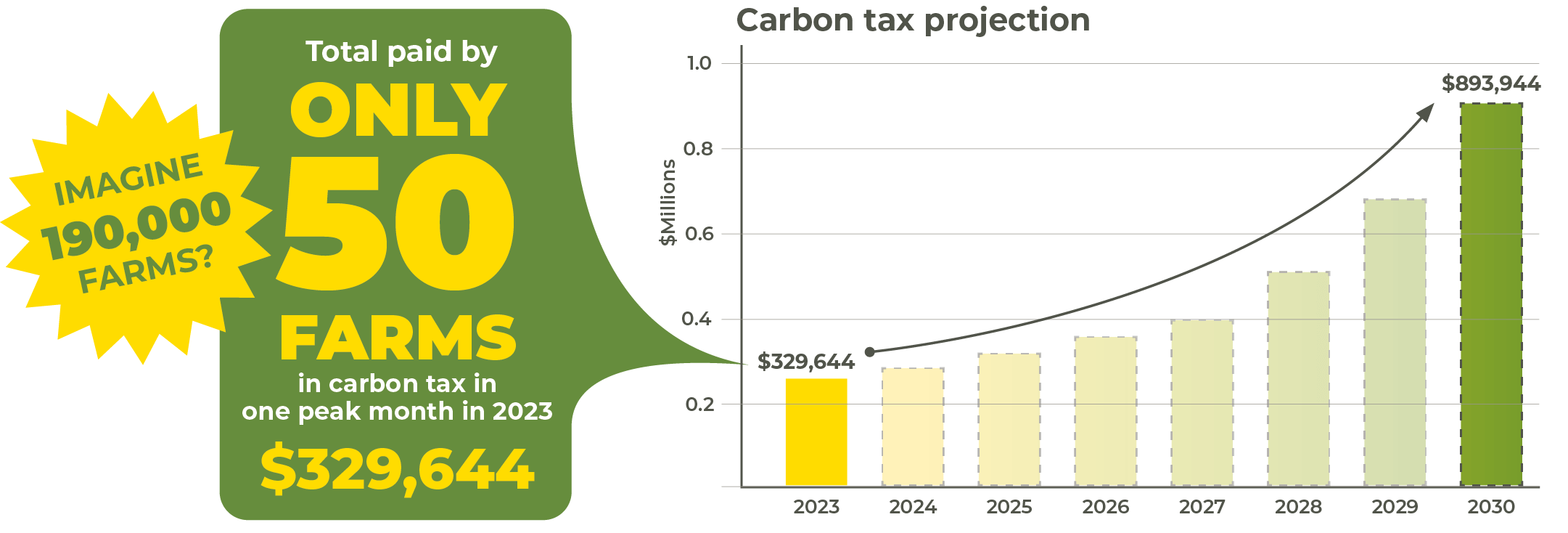

After analyzing the data, we collated the highest carbon tax receipt from each farm for one single month, providing a clear snapshot of the peak burden faced by farmers.

That total figure is projected to nearly triple over the next seven years to an imposing $893,944 by 2030, illustrating the compounding financial pressure as carbon tax rates increase over time.

50 sample farm operations paid a total of $329,644 for one month in 2023 in carbon tax.

These numbers are only from the farmers who sent in their receipts. If you expand to the 190,000 farmers across Canada, the impact on those who feed us really hits home.

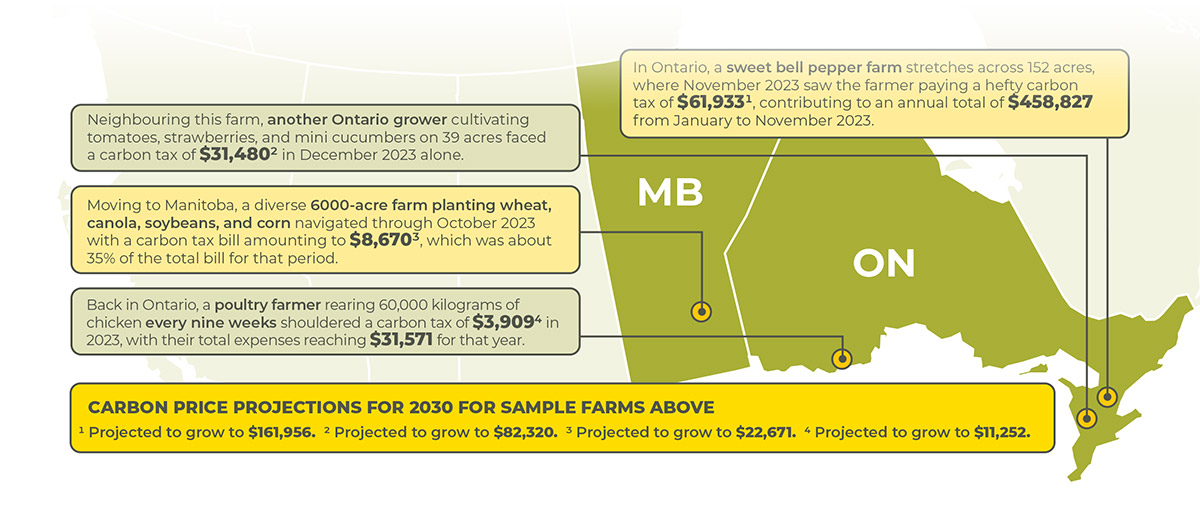

How the Carbon Tax Hits Home.

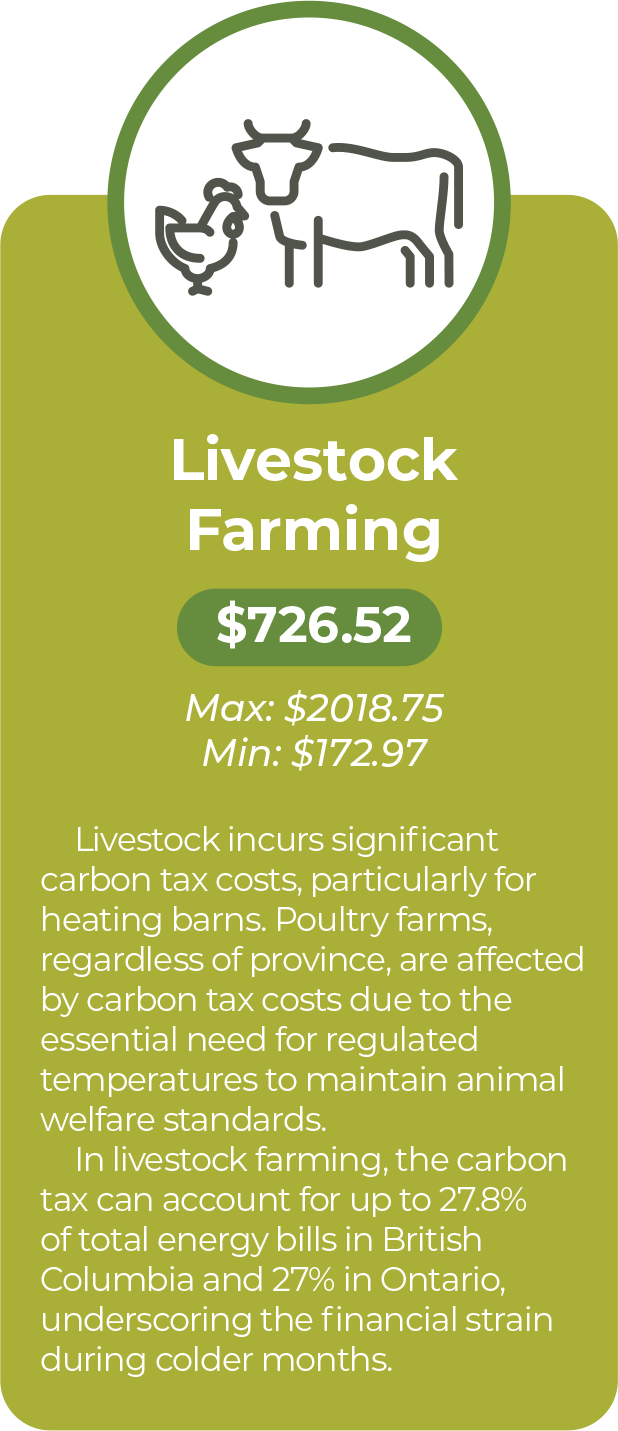

What Is The Sector-specific Impact For Canadian Agriculture?

National carbon tax average on farms for one month in 2023

We Need Your Support

This is why farmers, growers and ranchers need Bill C-234. To support farmers in their efforts, Bill C-234 would provide a much-needed exemption for qualifying farming fuel to marketable natural gas and propane.

A vote for Bill C-234 is a vote for: